When it comes to financial health, your credit score often acts as the single most important number. It reflects your repayment behavior, debt management, and overall credibility in the eyes of lenders.

For borrowers in India, knowing what counts as a good credit score range is critical. It not only determines loan eligibility but also shapes the interest rates you receive, the credit limits extended, and even how quickly your applications are approved.

This blog breaks down what a good credit score range in India is, why it matters, how it’s calculated, and how you can maintain or improve it for long-term financial benefits.

What is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. In India, this number typically ranges from 300 to 900. The closer you are to 900, the better your profile looks to banks, non-banking financial companies (NBFCs), and other lenders.

This is calculated by credit bureaus such as Credit Information Bureau India Limited (CIBIL), Experian, Equifax, and CRIF High Mark. These agencies compile your credit history, analyze repayment records, evaluate debt levels, and then assign a score that reflects your financial behavior.

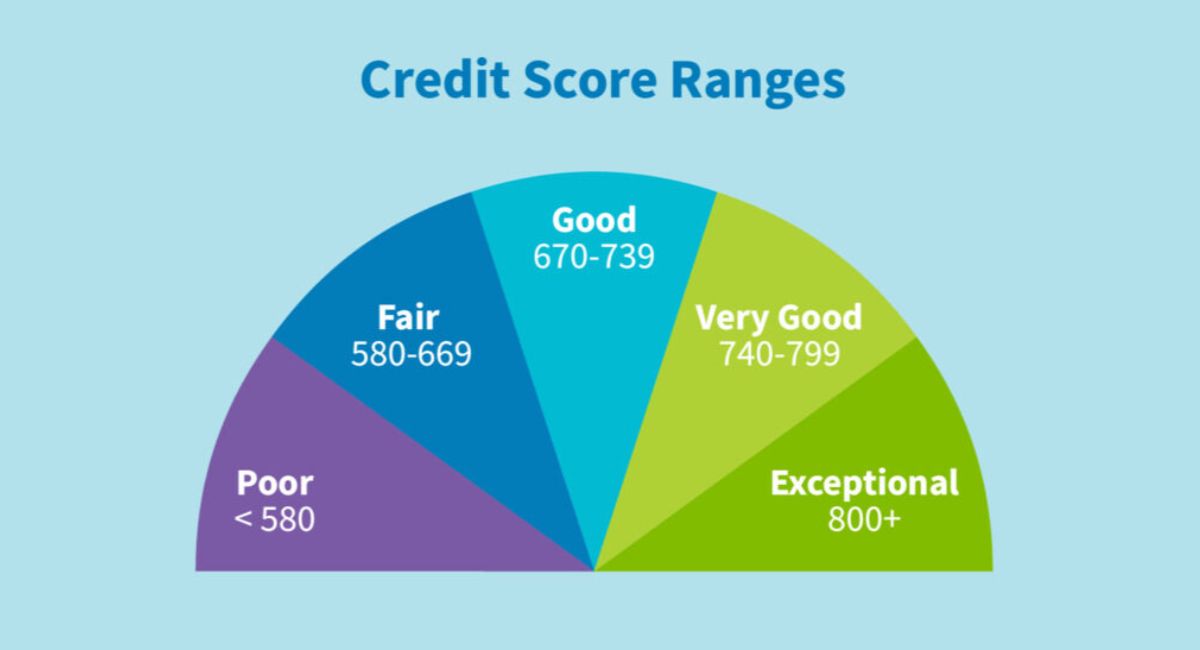

The Standard Credit Score Range in India

Here’s how scores are broadly categorized in India:

- 300 to 549: Poor credit score. Lenders see this range as risky, and loan approvals are rare.

- 550 to 649: Fair credit score. You may qualify for loans, but often at higher interest rates and stricter terms.

- 650 to 699: Average credit score. Lenders might approve credit, but conditions remain cautious.

- 700 to 749: Good credit score. Borrowers are generally eligible for credit with reasonable interest rates.

- 750 to 900: Excellent credit score. This is the most favorable credit score range in India. It unlocks easier approvals, higher limits, and competitive borrowing terms.

From this breakdown, you can see that a credit score above 700 is considered good, while 750 and higher is excellent.

Why Does a Good Credit Score Range Matter?

Maintaining a good credit score range isn’t just about borrowing money; it is about financial flexibility and credibility. Here’s why it matters:

- Loan Eligibility: A strong score above 700 increases your chances of quick approvals for personal loans, home loans, auto loans, and credit cards.

- Lower Interest Rates: Lenders see less risk in borrowers with a high credit score, which translates to better rates and reduced borrowing costs.

- Higher Credit Limits: With a healthy score, you can enjoy higher spending limits on credit cards and larger sanctioned loan amounts.

- Faster Processing: Applications from people within the good credit score range are often processed more quickly.

- Negotiation Power: Borrowers with excellent scores can sometimes negotiate better repayment terms with lenders.

How is Your Credit Score Calculated?

Although the exact algorithms vary between credit bureaus, most calculations consider the following factors:

- Payment History: Timely repayment of EMIs and credit card bills is the most vital factor.

- Credit Utilization: How much of your available credit limit you use.

- Credit History Length: Longer, consistent histories build stronger profiles.

- Credit Mix: Having both secured loans (like home loans) and unsecured loans (like personal loans) improves balance.

- New Credit Inquiries: Frequent applications for loans or cards may reduce your score.

Understanding these elements helps you manage your behavior to stay within the good credit score range.

How can You Maintain a Good Credit Score Range?

Staying within or improving your credit score requires consistent financial discipline. Here are key practices:

- Pay Bills on Time: Delayed payments have the most significant negative impact.

- Keep Credit Utilization Low: Avoid maxing out your credit cards; aim for under 30%.

- Maintain Older Accounts: Long-standing accounts add depth to your profile.

- Limit New Applications: Too many inquiries in a short time can signal financial stress.

- Diversify Credit: Balance secured and unsecured credit for a healthier profile.

- Check Reports Regularly: Errors in your credit report can drag your score down. Correct them promptly.

By following these habits, you can protect your standing in the good credit score range and enjoy long-term benefits.

Common Myths About Credit Scores in India

Here are a few myths surrounding the credit score in India:

- Checking Your Score Lowers It: This is false. Reviewing your own report is considered a “soft inquiry” and has no impact.

- No Loans Mean High Scores: Not true. Having no borrowing history can actually make it difficult for bureaus to assign a high score.

- Only Defaults Matter: While defaults have a strong effect, even late payments, overuse of limits, or too many inquiries can lower your score.

- All Lenders use the Same Score: Different banks may access data from different bureaus, leading to variations.

Clearing these misconceptions ensures borrowers make informed decisions about staying in the good credit score range.

Unlock Better Opportunities with a Good Credit Score Range

A good credit score range reflects your financial discipline and credibility. In India, scores above 700 open doors to easier loan approvals, reduced interest costs, and improved financial flexibility.

Through timely bill payments and maintaining low credit utilization, and monitoring your credit regularly, you can steadily build and maintain a healthy profile. Remember, your credit score influences nearly every major financial decision, from buying a house to getting a new credit card.

Staying within the good range ensures smoother access to funds and peace of mind. To track, understand, and improve your score more effectively, platforms like Olyv provide valuable insights and guidance. Start leveraging them today to secure a stronger financial future.